In recent years, many industries have been undergoing significant changes. A tough lesson many brands and manufacturers learned through the Covid-19 pandemic is that inexpensive but distant production and jammed ports of entry can wreak havoc on production timelines, inventory levels, and time to market.

One such industry that has been majorly impact? Textile and apparel.

Further complicating the matter for these producers, the new prevalence of work-from-home and hybrid work schedules as well as labor shortages and shipping delays have made companies reassess the efficacy of physical color approvals. Couple all of that with changing consumer spending habits and rapidly evolving color and design trends, and you’ve got a real headache to manage.

How can textile and apparel companies adapt? Mike Todaro, Managing Director of the Americas Apparel Producers’ Network (AAPN), offers some insight.

“We can’t keep doing what we did before the pandemic and expect different results,” says Mike. “It’s amazing how consumer shopping habits have changed. What we are seeing now is retailers stuffed with inventory. Brands are trying to figure out how to sell more with less inventory, move the inventory more quickly from production but also not run out of product and lose sales, not have to mark down prices, and actually make some money.”

Looking For A Better Way

A far-flung, widely dispersed supply chain and a time-consuming, error-prone physical color approval process (that worked “well-enough” prior to the pandemic) no longer meets the needs of brands – or consumers for that matter. Post-pandemic, a growing number of brands are looking for ways to prevent the issues seen in 2020 (and 2021…and 2022) while updating their processes to allow remote work, better communication and faster production with fewer disruptions.

While the problem seems complex, the solution lies in two main strategies:

- Digitalization of the color process

- Near-shoring production

Digitalization of Color Keeps Production Moving

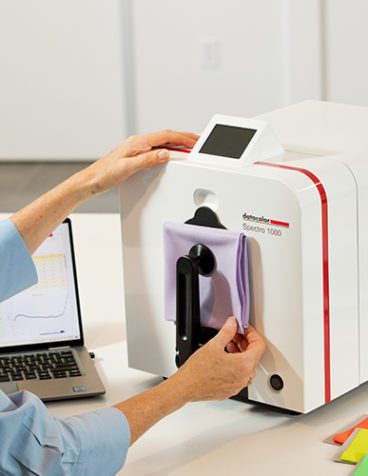

Digitalizing color in the textile and apparel industry has revolutionized the way fashion brands respond to trends and bring products to market. By using spectrophotometers to measure color, and software like Datacolor TOOLS to visualize, analyze, communicate and control color quality, brands can stay ahead of trends and meet consumer demands more readily.

When the color process is digitalized, it eliminates the need for physical color swatches, removes errors caused by subjective color assessment and manual color matching, and reduces the number of samples being shipped back and forth around the world for approval – saving time, resources, and money while reducing your carbon footprint.

Digital color management software, like TOOLS, also allows color workflows to adapt to work-from-home and hybrid work models without delay in the color approval process. Designers can work collaboratively with suppliers, manufacturers and retailers in real-time to submit and approve color from almost anywhere, significantly reducing lead times.

Near-Shoring Increases Speed to Market

Near-shoring means moving production closer to the market it serves. Since 2020, there has been a growing awareness of the importance of a stable supply chain and the vulnerabilities companies are potentially exposed to when suppliers are scattered around the world. By working with suppliers who are physically closer to end consumers, brands can protect themselves from some of the chaos previously brought on by the pandemic, the effects of which still linger in the supply chain today.

It’s not just American companies that are taking advantage of the benefits of near-shoring. Equally eager to reach the North American market with fewer disruptions is China. According to Peter S. Goodman, global economics correspondent for The New York Times, Chinese companies are investing billions of dollars into new factories in Mexico, just across the border from Texas, to save time and money getting their products to market faster. Not only is China trying to avoid shipping delays crossing the Pacific Ocean, they’re also taking advantage of free-trade between Mexico and the US.

While near-shoring resolves some problems, it does come with its own unique set of challenges. When switching suppliers, there is always the fear of fresh production delays as a result of the time it takes to determine supplier production capabilities, set quality standards and adjust to new processes. But Mike says US-based brands don’t need to worry because many suppliers in the Central American region are already “perfectly positioned” for today’s near shoring push – both geographically and technologically.

Discovering A Color-Capable Market

For some US-based brands, it’s a surprise to learn that switching to suppliers closer to home may not be as arduous as they thought. Latin America already has some extremely capable suppliers servicing the apparel industry and AAPN is here to show brands just how ready the region is for a near-shoring boom.

“There are a lot of brands, life VF Corporation, for example, that have used factories in this hemisphere for decades. They have what they call a ‘third way’ program with really tight partnerships with factories, and they also work with independent contractors. NAFTA and other trade pacts caused globalization to spread rapidly, but there are really big companies that never left,” says Mike.

These long-time suppliers to brands like VF Corporation in Central America have honed their skills over the decades and are eager to take on brands seeking to near-shore. In fact, some suppliers are so confident in their trend and color capabilities that they tell the brand what they’ll be making next season rather than the other way around.

“When AAPN went into Central America for the first time in 2001, the factories were just sewing,” explains Mike. “A container would arrive with piece goods and they would sew them together and ship it back. But today you’ll find factories that go to their customers in the States, not asking what they want next season but presenting what they’re going to make with the suggested retail price. And it’s all color-driven. You find many color skills throughout the region today.”

Why Are Color Skills Important?

The ability to efficiently and accurately color-match across a supply chain is a huge factor in the speed to market. If a brand’s goal is shortening the time from design concept to store shelves, an efficient color management program can take days or weeks off the production cycle.

For brands looking to near-shore in Central America, the fact that established factories tend to have a good grasp on color processes is an additional benefit. But how do brands know which factories are color capable?

If suppliers want to attract brands, one way to do so is to have their color process, workers and technology accredited through a program like Datacolor Certify. This program verifies to brands that a supplier is qualified and capable of meeting brand color quality expectations. Not only does it give brands confidence that a given factory can meet their specifications, it also helps suppliers attract new business and build trust. “You’ll never have speed until you have trust,” insists Mike.

Redefining the Way We Think About Cost

The pandemic not only transformed our view of the supply chain, it also changed the way brands and suppliers think about cost. Instead of focusing solely on chasing the cheapest product, companies are now more concerned with speed, efficiency and reliability in their supply chains.

“One of the things that changed universally is the concept of ‘chasing cheap'”, Mike explains. Brands were stretching their supply chains around the world in order to reach cheaper means of production. In 2020, we saw already stretch supply chains break down. Products couldn’t ship because there weren’t enough workers to unload boats. Brands had to rethink the math behind doing business that way and for some of them, near-shoring (despite the uncertainty and time-cost of doing so) was the obvious solution.

The Future of the Textile Industry in the Americas

As near-shoring continues to gain traction, the AAPN is playing a significant role in promoting the Central America region as an attractive alternative for sourcing. The organization has been involved in numerous high-level initiatives and investments aimed at bolstering the textile industry in the region, including the Partnership for Central America (PCA).

While the textile industry continues to adapt to new challenges and opportunities, near-shoring and the increased focus on supply chain efficiency will play a crucial role in shaping the future of the textile and apparel industry in the Americas.

Quotes in this blog were taken from Mike’s 2023 Datacolor Textile Color Summit presentation “Uncovering the Obstacle of Near-Shoring”